It’s not the news you wanted to hear but the energy price cap is going up once again from October.

That means your energy bills are likely to get more expensive, as the cap of £1,568 that had been in place between 1 July and 30 September is going up to £1,717 from 1 October to the end of the year, an increase of about 10 percent.

Just to refresh your memory, the energy price cap refers to the maximum amount providers can charge for each unit of electricity and gas, so the costs are a guide for them and not you.

Those figures don’t mean you can’t pay more than that for energy, it’s what a ‘typical’ UK household on a direct debit would pay for electricity and gas in a year.

Anyhow, the cap is going up so that means you’ll almost certainly be paying more in your energy bills.

Prices are going up… again. (JUSTIN TALLIS/AFP via Getty Images)

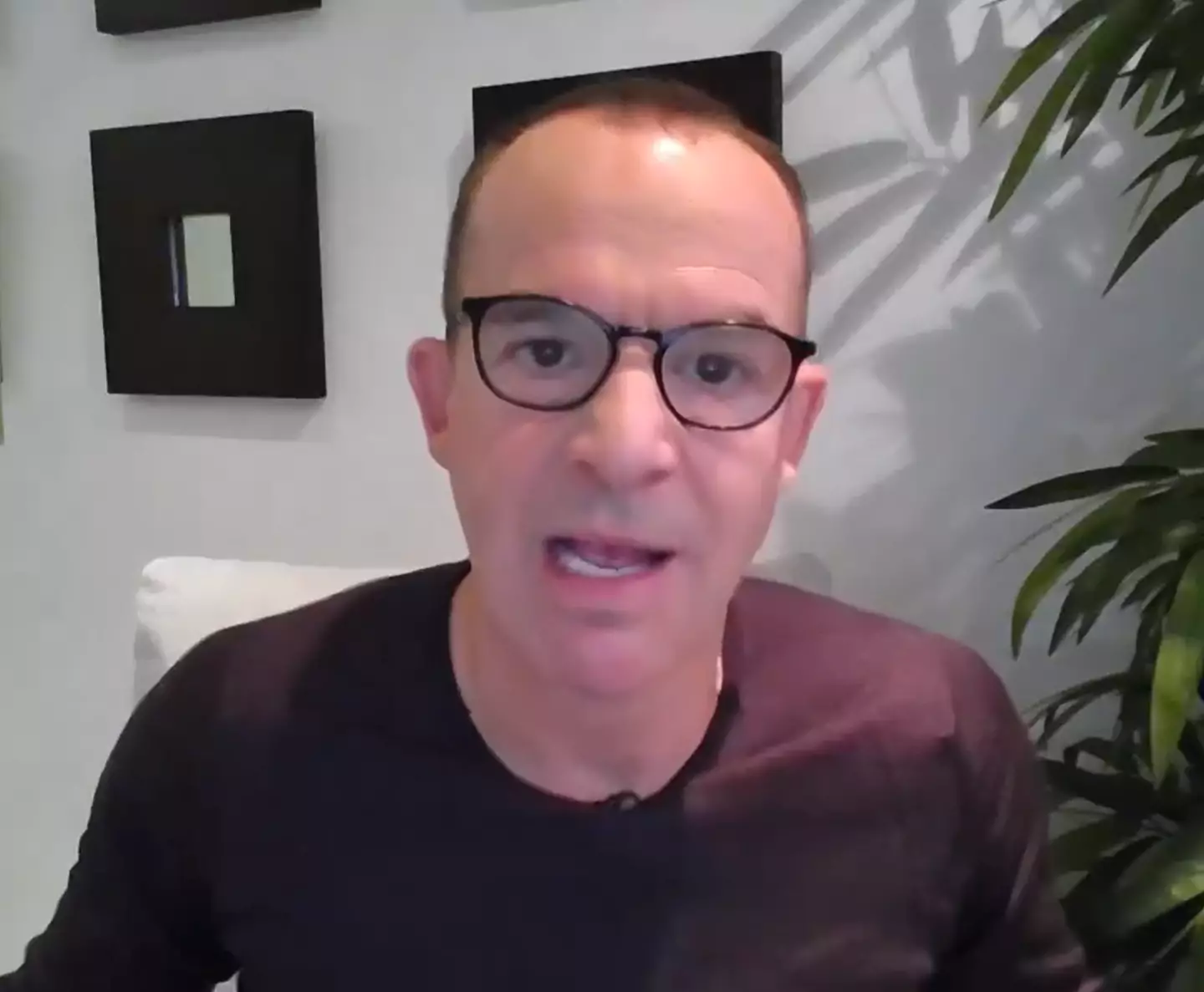

In comes the champion of your bank balance, Martin Lewis himself, who has talked about the things you need to be on the lookout for and things you might be able to do.

He recently posted a lengthy video on Twitter detailing his thoughts, and his Money Saving Expert site has put out a lot of useful information for you.

During his video he spoke about the ‘moral hazard’ of the energy price standing charge, the amount of money you pay just to be able to access your gas and electricity.

Lewis explained that you’d be paying 60.99p per day for electricity and 31.66p per day regardless of how much you used, with the expert calling this ‘a poll tax on energy bills’.

“You’re going to pay £334-odd a year just for the facility of having gas and electricity meters, even if you don’t use them.

“Many people don’t use gas in summer, but pay 32p a day just for that facility.”

Martin Lewis called standing charges a ‘moral hazard’ and gave some advice on how to soften the price rises. (Twitter/@MartinSLewis)

With the cap rise that figure is going to rise to about £338 a year, and Lewis warned it ‘penalises lower users, often many who are vulnerable, and means they will face a proportionately larger rise’.

You can cut your energy consumption as much as you like but this payment is still going to be coming out of your pocket.

Elsewhere, he advised people on how to deal with the cap rise of around 10 percent, with his site saying customers might want to get a fixed rate now to insulate themselves against future price rises.

Major energy providers like OVO, British Gas, E.on and Octopus Energy have fixed rates which are slightly higher than the current cap but will be lower than the one that comes in for October.

In essence you’d be putting your prices up a bit more now to avoid them going up by even more later on.

Lewis said it was ‘safer to get it sorted now’ and shop around for a better deal than sit back and wait for the rise that’d come with the price cap increase.

Featured Image Credit: ITV

Topics: Martin Lewis, Money, Cost of Living, UK News

Martin Lewis’ Money Saving Expert (MSE) team has issued a simple message after it was revealed that household bills across the United Kingdom will be going up in autumn and winter by almost £150.

Ofgem, which regulates the energy industry in the UK, announced today (23 August) that the average household bill was going to increase as it rose the price cap for homes.

It is bad news for Brits with winter now only around the corner but Ofgem says it is necessary due to increased political tensions around the world combined with extreme weather events.

The regulator announced it is hiking its price cap by 10 percent from the current £1,568 for a typical household in England, Scotland and Wales to £1,717.

It is around £117 cheaper than the cap in October last year, though, which was £1,834.

Despite the year-on-year fall, the increase going in to the colder months will be a bitter pill for millions of Brits after a summer where prices were at a low while many weren’t using their central heating systems due to the mild weather.

Millions of pensioners are also facing a winter with less support after the new Labour government scraps winter fuel payments for those who do not receive pension credits or other benefits.

About 10 million pensioners will miss out on the payments of up to £300 this year.

Energy bills are rising (Getty Stock Images)

Jonathan Brearley, chief executive of Ofgem, said: “We know that this rise in the price cap is going to be extremely difficult for many households.

“Anyone who is struggling to pay their bill should make sure they have access to all the benefits they are entitled to, particularly pension credit, and contact their energy company for further help and support.”

Following on from the announcement Martin Lewis’ MSE team issued how the price cap increase will impact you.

“The Price Cap changes every three months, and is set to rise from October due to higher wholesale energy prices in recent months” MSE said.

Lewis’ MSE team have issued a statement (ITV / This Morning)

“Here’s what the Cap will be set at from 1 October. If you pay by monthly direct debit, it’s £1,717 a year on average for a typical dual-fuel household, affecting all those on standard variable tariffs (essentially everyone not currently on a fix). This is a rise of 10 percent.

“If you prepay for your energy, prices will rise by 10 percent to £1,669 a year.

“If you pay on receipt of a bill, it’s a 10 percent rise to £1,829 a year.”

It’s very easy to get lost in the numbers behind the energy price cap, as the big number isn’t a guarantee of what you’ll pay. Rather, it all comes down to usage and that’s what the message from the MSE is.

“Remember, it’s the rates that are capped, so use more and you pay more,” they said.

The average energy bill will now be £1,717 a year (Getty Stock Images)

Energy Secretary Ed Miliband said the announcement ‘will be deeply worrying news for many families’.

He blamed the price cap hike on the ‘failed energy policy we inherited, which has left our country at the mercy of international gas markets controlled by dictators’.

He said: “We will also do everything in our power to protect bill payers, including by reforming the regulator to make it a strong consumer champion, working to make standing charges fairer, and a proper Warm Homes Plan to save families money.”

Show less

Featured Image Credit: ITV / This Morning / Getty Stock Images

Topics: Martin Lewis, Money, UK News, Cost of Living

The cost of living crisis continues to bite hard on the pockets of millions of Brits just looking to get by.

Well, it’s time to grimace a little more when it comes to your energy bills, according to none other than finance guru Martin Lewis.

Lewis is an avid user of social media, using it to share his tips and tricks with his huge following while also sharing the success stories of real people to show that what he’s saying can have real life changes.

Very often, he’s spending his days sharing ways to save money. And one of the latest offerings explains how you say, in the words of his Money Saving Expert team, save more than £1,000 every year on a ‘forgotten’ bill.

Pocketing nearly £200 for free by changing bank accounts is also on the cards, as well as £520 in compensation for delays to your flights at any point in the last six years.

Unfortunately though, not all his advice is about making or saving money.

Sometimes, it’s about telling the reality of the situation even if that is grim. Because the truth of the situation is better than finding yourself short of cash before payday and having unexpected bills to pay.

That’s certainly the case when it comes to the cost of gas and electricity bills in the country.

Last month, Ofgem – the UK’s energy regulator – lowered the energy price cap by seven percent.

Strong words from Martin Lewis, as always. (ITV/GMB)

In real terms, this meant the then £1,690 a year costs for a typical gas and electricity bill in England, Scotland and Wales fell to £1,568.

That’s more than £120 a year saved if the levels stay the same and a whopping £500 a year less than July two years ago.

Well, it’s not all good news, according to Lewis.

The Mancunian took to social media to issue UK energy customers – the majority of which are signed up to Octopus, EDF Energy, NPower, British Gas, Eon – a fresh warning when it comes to their bills.

It came during the general election debate on Tuesday night (4 June) between Labour’s Keir Starmer and the Conservative’s Rishi Sunak.

Energy bills are still as expensive as ever. (Getty Stock Images)

On the issue of energy costs, Lewis took to X (formerly Twitter) to speak about the reality of bills come autumn 2024.

“It is correct to say that energy prices are predicted to rise this year at the moment, though its not set in stone,” Lewis wrote.

“Current prediction is energy price cap to rise 12% in October, which will mean paying more than we do right now, even after the seven per cent July drop.”

In simple terms, it means most energy suppliers are likely to raise the cost of your gas and electricity by 12% in line with the recommendation by Ofgem. They could bring in a lower rate, but there’s no guarantee.

After Ofgem lowered the energy price cap in May, Lewis took to social media to issue advice on the long term picture for the UK.

.jpg)

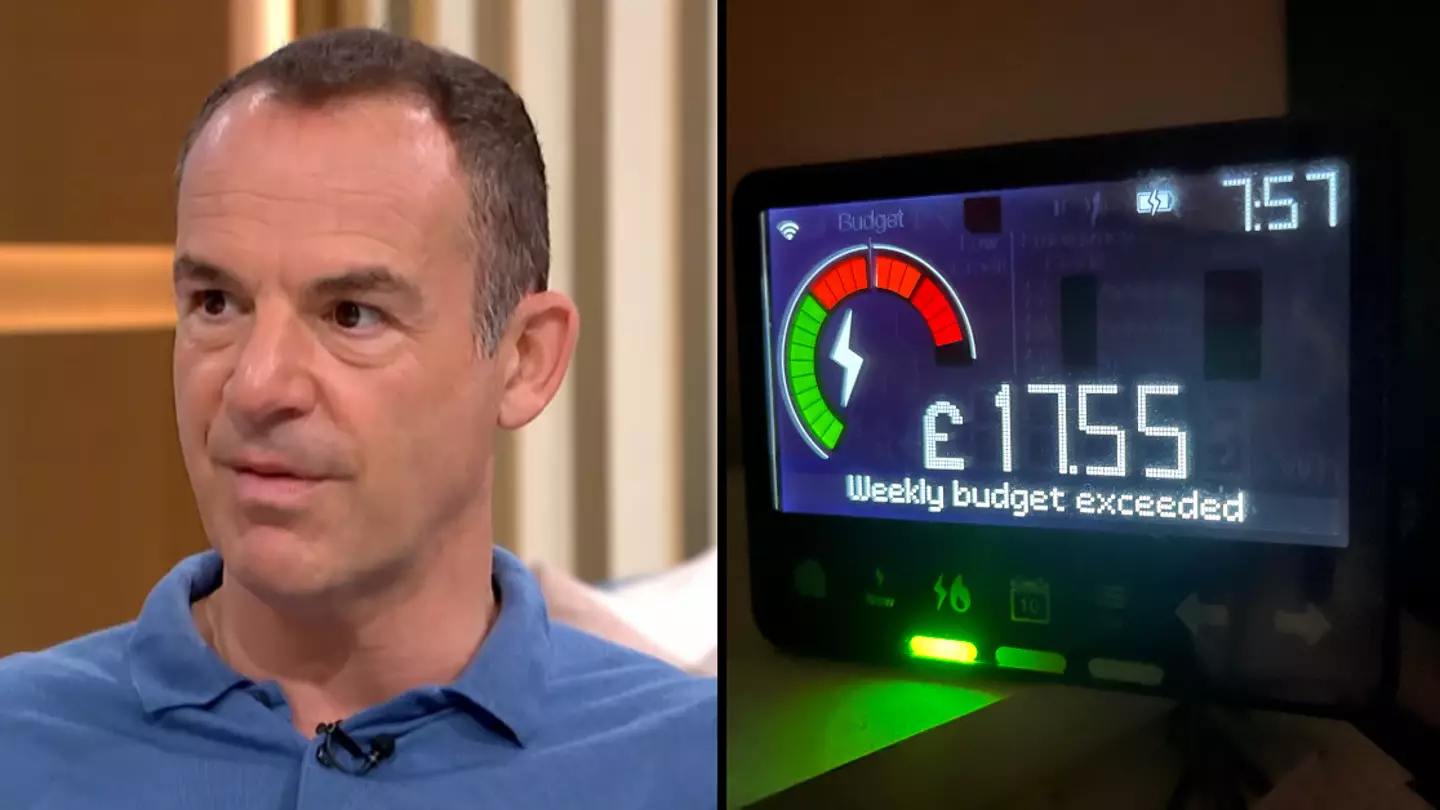

Smart meters tell you how much you’ve spent every day (Getty Stock Images)

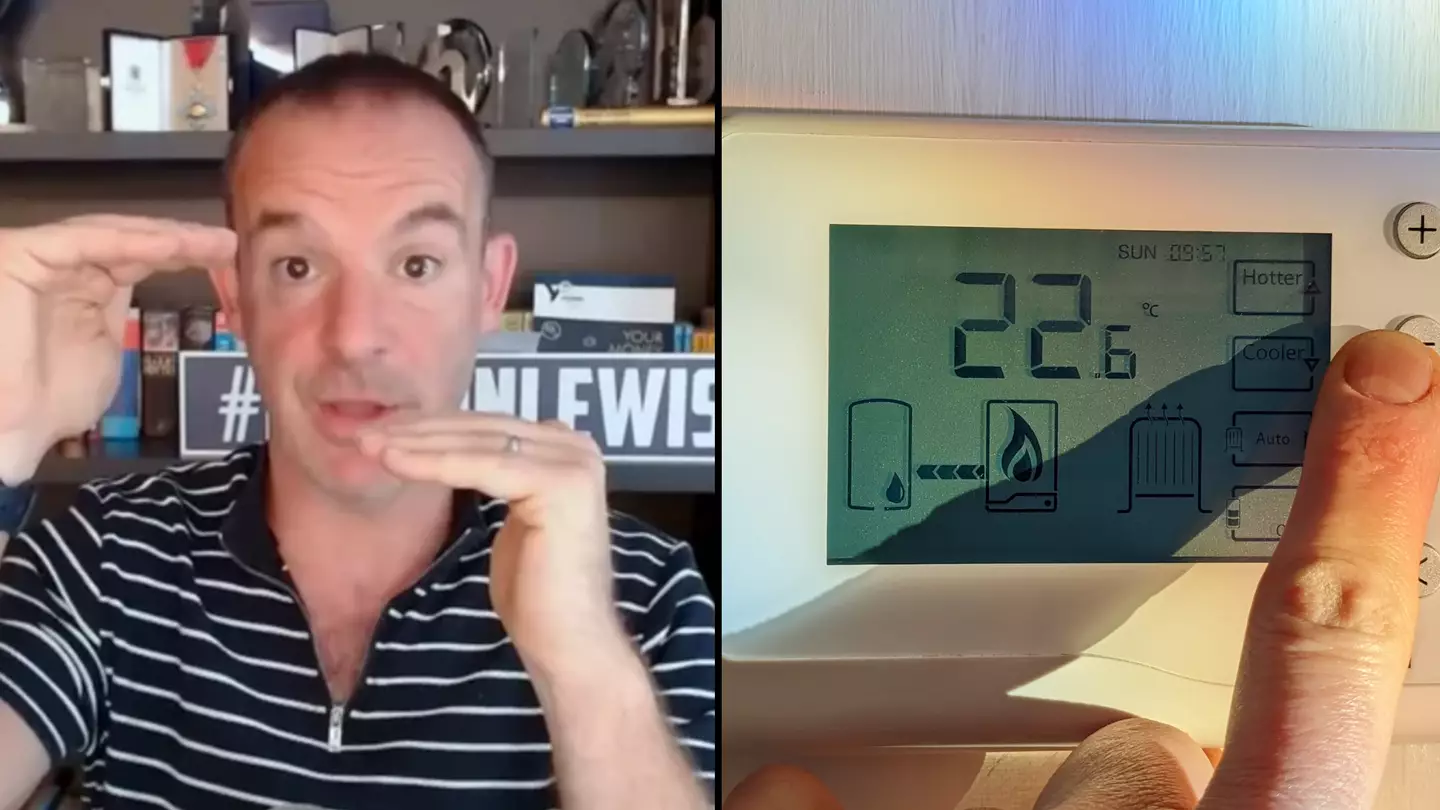

Labelling one part of his advice as ‘the ugly’ part, Lewis wrote: “The Cornwall Insight has put out its new predictions and they don’t make easy reading.

“If they’re right this is the last fall, and the coming rises are big. On 1 July it has confirmed it drops 7%, so for every £100 paid today you pay £93.

“Then on 1 October it’s predicted to rise 12%, so you’ll go back up and be paying £104. Then on 1 January the crystal ball is saying it’ll stay flat (at £104)

“All this makes the cheapest fixes which are currently 9% cheaper than now (so £91 per £100 on the price cap) look a decent bet.”

Featured Image Credit: ITV/GMB / Getty Stock Images

Topics: Martin Lewis, Money, Cost of Living, UK News

Martin Lewis has explained why British Gas, EDF, OVO and Octopus Energy customers should send out an email before Monday.

I know everyone will be enjoying their Easter break this weekend, but the Money Saving Expert founder has suggested that you should send the email out to your energy provider for ‘extra peace of mind’.

The 51-year-old has noted that for those who have a working smart meter, ‘you don’t need to do anything’.

ITV

This all has to do with the new Ofgem price cap, as Lewis has explained to his subscribers what we need to do.

He wrote: “On Easter Monday, 1 April, the new April to June Energy Price Cap kicks in, falling on average by 12% – an improvement, though energy is still hideously costly.

“This Price Cap dictates the rates most people pay for energy, as it sets the max firms in Eng, Scot & Wales can charge for their standard tariffs (and almost all charge the max, natch) – which c. 90 per cent of homes are on (pretty much everyone not on a fix or EV tariff).

“In simple terms, it means on average for every £100 you currently pay, you’ll pay £88 from Monday.

“Yet the fact prices are dropping doesn’t mean you should sit on your heels, there are Cheaper switches & fixes worth looking at too.

“So let me take you through everything you need know to protect your pocket.”

ITV

So, from 1 April to 30 June 2024, energy prices are capped at £1,690 per year for a typical household who use electricity and gas and pay by Direct Debit.

Lewis explained: “If you’ve a working smart meter, you don’t need to do anything.

“If not, try to give an up-to-date meter reading within a few days either side of the rate change to reduce the risk your supplier estimates you’ve used more at the current higher rate than you have.

“For extra peace of mind, email yourself a time-stamped pic of the meter.”

Lewis’ advice this morning comes after he revealed how people can get their hands on genuine free money.

ITV

He’s talking about switching bank accounts, with massive cash offers on offer for you to leave your current bank.

He said: “We told you last week that four banks now offered free cash switching deals, a big turnaround from none a few weeks earlier. Yet no apologies for doing it again, as it’s all change, and this is likely the week you’ve the maximum choice of where to go.

“Switchings usually quick and easy. You need to go via the bank’s seven-working-day switch service, which closes your old account and auto-moves your balance, standing orders and Direct Debits.

“Once done, any payments to your old account are auto-forwarded. You’ll need to pass a not-too-harsh credit check.”

When times are harder and more expensive than ever, it’s worth a thought!

Featured Image Credit: ITV/Getty Stock Photo

Topics: Martin Lewis, Money, UK News

Saving for a holiday is hard enough as it is, the last thing you need is to be charged twice for it.

But that’s exactly what happened to some holidaymakers looking for some sun, sea, and sand.

The extra charge is accidental, the airline says, but it’s left customers deeply out of pocket, with thousands more taken out of their bank accounts than they had initially expected.

So it’s lucky the financial whizz Martin Lewis is on hand to save the day, yet again.

Posting on X, one devastated customer contacted BA directly to vent their understandable frustration.

“@British_Airways I’ve been charged twice for my flights, now in my overdraft. I’m unable to get through on the phone or chat, I just get a message you’re too busy and to try later,” they wrote.

“I need this correcting asap and are you going to convert any fees that I’m charged by the bank?”

PA

Another user responded: “The same has happened to me. I’ve just managed to speak to someone who said they’re aware of the problem. BA might like to have addressed this with their customers!”

Another added: “@British_Airways you’ve taken £4,200 out of my account twice to pay for my flights (taken not pending). Rang BA and told it’s a known system issue and the refund will take three days. How can you take >£4K more than you’re entitled to and not send a single email to explain the error?”

Fortunately, however, Martin Lewis has now got involved to offer some of his wisdom following the fallout from the mix-up.

PA

Issuing advice to those affected, his website says: “British Airways told us that all refunds have now been processed and should arrive in customers’ accounts shortly.

“Exactly how long it’ll take to receive this payment will vary depending on your bank, so make sure you keep an eye out for the payment.

“If you don’t receive a refund from British Airways as expected, or you’re unhappy about the treatment you’ve received, you can make an official complaint via British Airways’ website.”

On top of this, MSE says that if you have had to endure extra costs as a result of this, you should go directly to British Airways with your grievance. This could be if you’ve incurred extra overdraft or credit card fees. To do this, MSE says visit the BritishAirways.com and select ‘Bookings and reservations’ where you should provide evidence of extra costs you have incurred.

A spokesperson for British Airways, which has not revealed how many people have been affected, said: “We’ve apologised to those customers who were incorrectly charged for bookings. All refunds have now been processed and should arrive in customers’ accounts shortly.”

They added that no one would be ‘left out of pocket’.

Featured Image Credit: PA

Topics: Martin Lewis, Cost of Living, UK News, Money